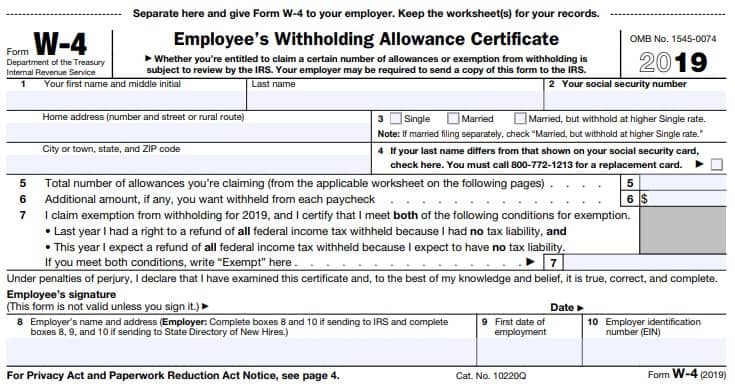

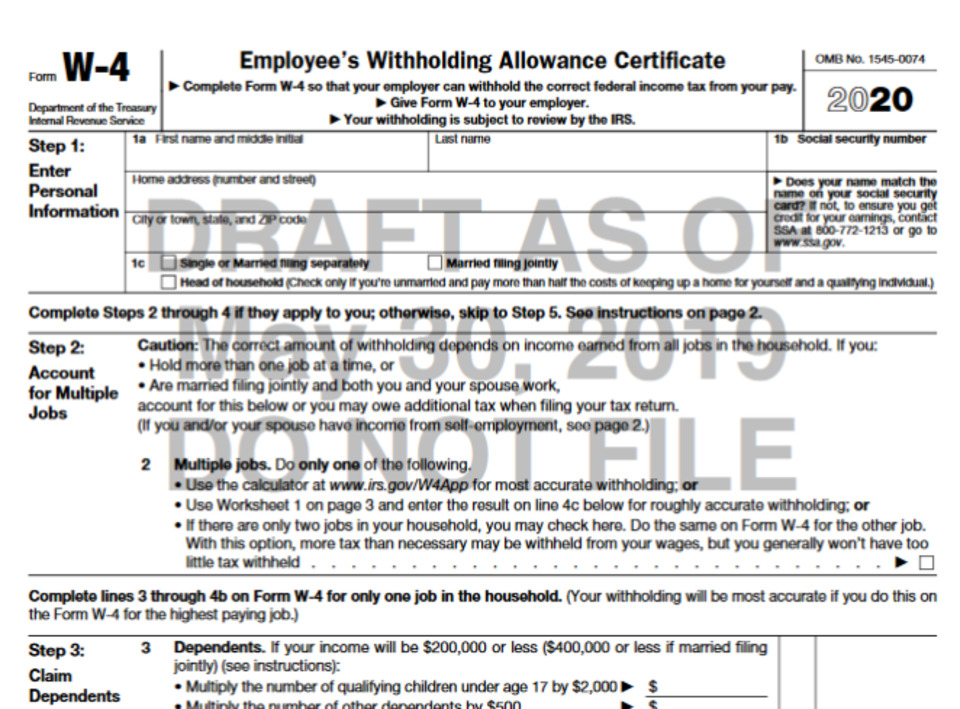

Employees who are eligible to be exempt from withholding, and those who file as non-resident aliens should use the space below Step 4(c). The new form doesn’t have married but withhold at higher single rate is gone.Īs with the prior version of Form W4 non-resident aliens should designate their status if they’re subject to the special withholding rules in IRS Notice 1392 entitled Supplemental Form W-4 Instructions for Non-resident aliens.Įmployees eligible to claim exempt from withholding will notice that the new form is different. The new form changes single to single or married filing separately and includes head of household. One difference from prior forms is the expected filing status. Let’s look at these important points about the new Form W-4. The form has steps 1 through 5 to guide employees through it. Unlike the old form, there are no withholding allowances – which is why the title of the form changed to Employee Withholding Certificate. Each employee is responsible for their own withholding.Īn employer doesn't know the taxpayer's situation, so there's no way for the employer to know what to withhold without Form W-4.

And, although employees don't have to give employers an updated Form W-4 they should be encouraged to update their Form W-4. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. How Form W-4 has changed 2.Where to find instructions 3.Where to estimate withholding.Now, let’s begin.

#Irss w4 form how to#

Hello and welcome to this presentation on the latest Form W-4 – and how to use it to compute withholding.

0 kommentar(er)

0 kommentar(er)